Birkenstock’s new concept store @ Duxton, Singapore

Birkenstock’s new concept store caught my attention - no other stores in Singapore had this concept. My wife and I were nearby, so we paid it a visit. I have been looking for a pair of Birks for a long time, and was heading in with the intent to purchase.

While purchasing, I had a short conversation with the store manager, and found out that this was the first Birkenstock-ran store in the whole of Asia Pacific, which got me thinking about Birk’s DTC (direct-to-consumer) expansion plans. Sitting back to observe the rest of the customers - the conversion rate is high. Most come into the shop with intent to purchase (like me 🤣) and leaves with a pair. Some are even looking for the higher-value footware, like the Stussy suede collabs.

It then dawned on me: Post IPO, LVMH is finally ready to launch its playbook in the rest of APAC for Birkenstock.

Introduction

Birkenstock is a long-standing slipper brand, operating since 1774. The firm prides itself for the soles of its slippers which imitates nature’s terrain, providing more ergonomic support. It provides an entire range of designs to suit different tastes, being its Core Silhouette designs.

This got me interested in reading up on Birkenstock’s prospectus in depth. The firm listed in Oct ‘23 under the ticker NYSE:BIRK. The key purpose of the IPO was to change its capitalization structure - replacing debt with equity.

Key investment highlights

LVMH’s playbook, ownership and Board presence

LVMH has a long history of spinning off its subsidiaries for cash. Minority stake of each brand is sold to the public, with the cash reinvested into the company. The most prominent example is Dior, the brand that started it all. LVMH is now applying the same to Birkenstock. (From here on, LVMH will be used in place of L Catterton)

In Apr ‘21, L Catterton, the Arnault family’s private equity arm, acquired Birkenstock. 2 years in, L Catterton puts c. 12% of its equity on the stock market while retaining the remaining 88% (5% under Agache, a subsidiary within the LVMH group; remaining by L Catterton).

There lies the first investment highlight - LVMH is reusing their playbook, generating cash from public markets for expansion. LVMH’s objective doesn’t seem to be an exit (i.e. not a private equity play). In comparison, footware peers like Dr Martens and Crocs are largely owned by institutions post listing.

LVMH also places Alexandre Arnault on the Board to bring LVMH’s expertise in luxury brand building to Birkenstock. LVMH specialises in bringing outdated brands back to life; Tiff & Co under Alexandre’s leadership was steered back to growth post LVMH’s acquisition. Other LVMH-related Board members include Michael Chu, Ruth Kennedy and Nisha Kumar. This shows LVMH’s intention to steer Birkenstock towards success.

With high equity ownership and strong Board presence, I believe Birkenstock’s success will be a strong priority for LVMH.

Moving to own their distribution channels, and expansion in Asia

Management is pushing for huge change on its distribution channel, increasing proportion of DTC revenues over third-party distribution. This is a move to own their distribution channels (i.e. retail fronts), cutting off middle-men and increasing margins.

Between 2018 and 2022, Birkenstock management reduced third-party distribution’s revenue contribution from 32% to 14% of revenue.

Birkenstock-owned retail fronts are typically in US and Europe. The store @ Duxton is the company’s only self-owned store in the whole of Asia Pacific, and comprising of a differentiated concept (it looks like a traditional chinese medicine shop, which makes it unique and catches attention). I believe that signals the start of Birkenstock’s goal to expand in the Asia Pacific, which would drive strong growth. We’ve seen a hugely successful story with Lululemon in China and the rest of APAC; Birkenstock could follow the same storyline.

Birkenstock’s strong brand power - customer perception and conversion

CEO Oliver Reichert is quoted in the prospectus:

“Consumers buy our products for a thousand wrong reasons, but they all come back for the same reason…… average Birkenstock consumer in the US owns 3.6 pairs today”

This might be the company’s way of inflating its brand proposition on its prospectus, but my experience in the shop shows that its true. Customer conversion is high. Every customer enters with purchase intention, and leaves with at least a pair. That includes a father that bought a pair for his toddler within 10 mins of entering (to be fair, his son looked really cute in them!😄). Birkenstock’s large range of slippers provides a purchase entry point from the slightly budget-conscious to the luxury seekers (the 1774 series costs more than US$500 per pair). Brand power is very strong.

German-made ONLY

On Supply, the luxury playbook states that production must be kept in-house; it cannot be outsourced to a cheaper country, and it must be kept within the country of origin. Birkenstock keeps its production within 6 of their factories in Germany, with one on its way. Factories are the firm’s only capital expenditure.

This is in contrast with its competitors, mainly Crocs, which has completely outsourced its production to China. The contrast: Birkenstock’s management aims to grow as a luxury brand; Crocs aims to become a commoditised good. If successful, this will give Birkenstock strong pricing power, strong branding power, and ability to reap luxury margins.

So, is BIRK worth investing?

Qualitatively, Birkenstock seems like a company primed for growth. LVMH’s huge shareholding shows that the brand’s success is quintessential.

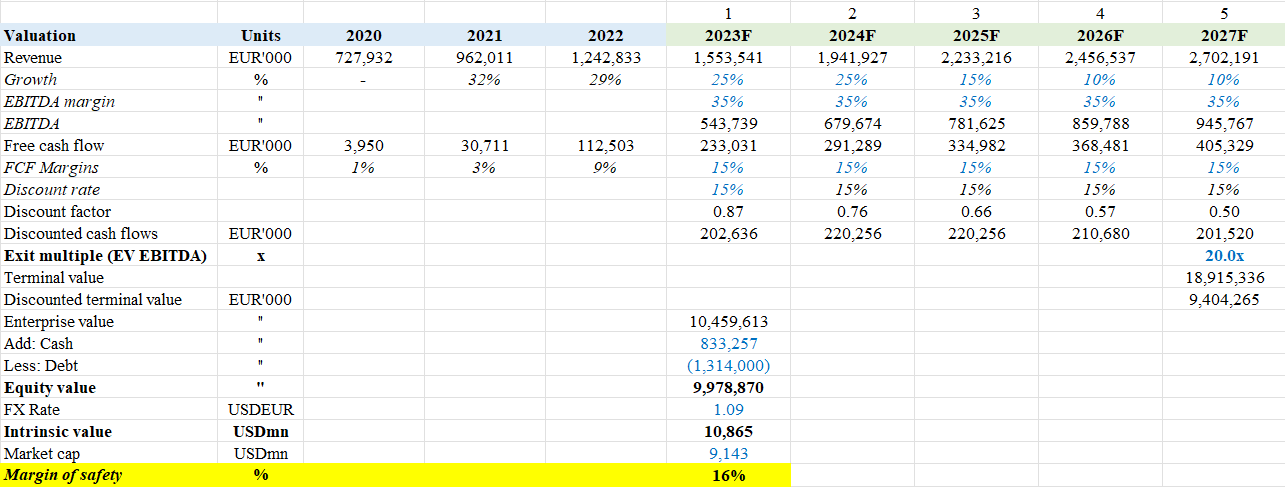

However, the stock’s valuation seems rich at the moment. Assuming aggressive revenue growth of 25% for first two years, tapering down to 10% by the fifth year, we would only get a 16% margin of safety, which is slightly light for aggressive assumptions. From a multiples standpoint, it is currently trading at c. 50x P/E (FY22), which is an expensive figure for a footware (even luxury) company!

A drop in share price to allow at least a 30% margin of safety would be preferred. However, while it looks expensive, the multiple may continue to expand, which may turn this into a mistake of omission. Case in point is Lululemon: When LULU was trading at c. 33x P/E in Dec ‘22, my conclusion was that it was too expensive. It has now expanded to 63x, turning into a one-bagger already, and is now a mistake on omission.

Perhaps erring on the side of caution would be the wiser choice here, especially for BIRK which is a newly IPO stock. An opportunity might arise post lock-up period.

Disclaimer: This research report is not to be construed as financial advice in any shape or form. The author may or may not hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article.

Now I feel like getting a pair of Birks